Financial advisors tell us that if we depend solely on Social Security as a form of retirement income, we will not be able to maintain our current lifestyle. For many, it will be very difficult to even provide ourselves with the most basic necessities including food, shelter and healthcare.

As public employees in Iowa, we are also eligible for the Iowa Public Employees’ Retirement System (IPERS) that will also provide us with retirement income. IPERS serves many of our retirees well; however there is more that we can do to help ourselves be self-sufficient and enjoy our retirement years by saving through a 403b plan. An added benefit is that the money we have deducted from our paycheck and deposited into our 403b plan can be deducted pre-tax to lower our tax liability now.

Check out the Retirement Investors’ Club for some useful information on investing. Make sure you go directly to the site via the link provided above or via the Infinite Visions portal (My Benefits>Retirement>403b RIC State Website) to ensure you accessing the applicable information for educators.

Each year, the Business Office sends an annual notice with your W2 form. Here is the 2017 Annual Notice if you would like to review this document. If you haven’t taken time to review the notice, please consider doing so as it contains some important information on this topic.

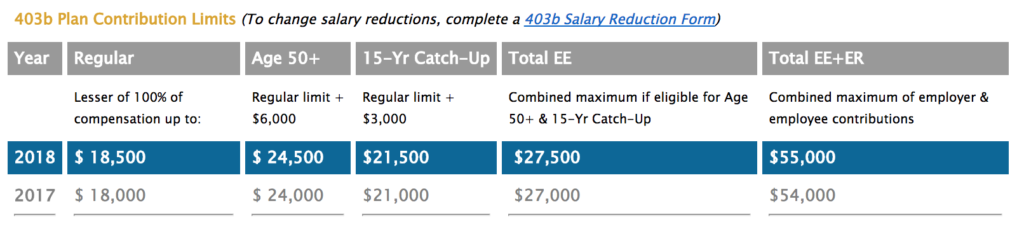

2018 Contribution Limits: Contribution limits have increased for calendar year 2018. Additional RIC 403b plan contribution information is available at https://das.iowa.gov/RIC/40