Updated 2024 W-4 form

Due to the enactment of Senate File 565 being passed by the Iowa Legislature in 2023, the Iowa withholding tables and the IA W-4 were revised, effective January 1, 2024. The Iowa Department of Revenue (IDR) is encouraging all employees to fill out the new IA W-4. Some important things to note:

- You are allowed to complete the new form electronically, but you will need to print, sign and scan/send to payroll@centralriversaea.org.

- Please complete the form as soon as possible and return it to payroll no later than January 10.

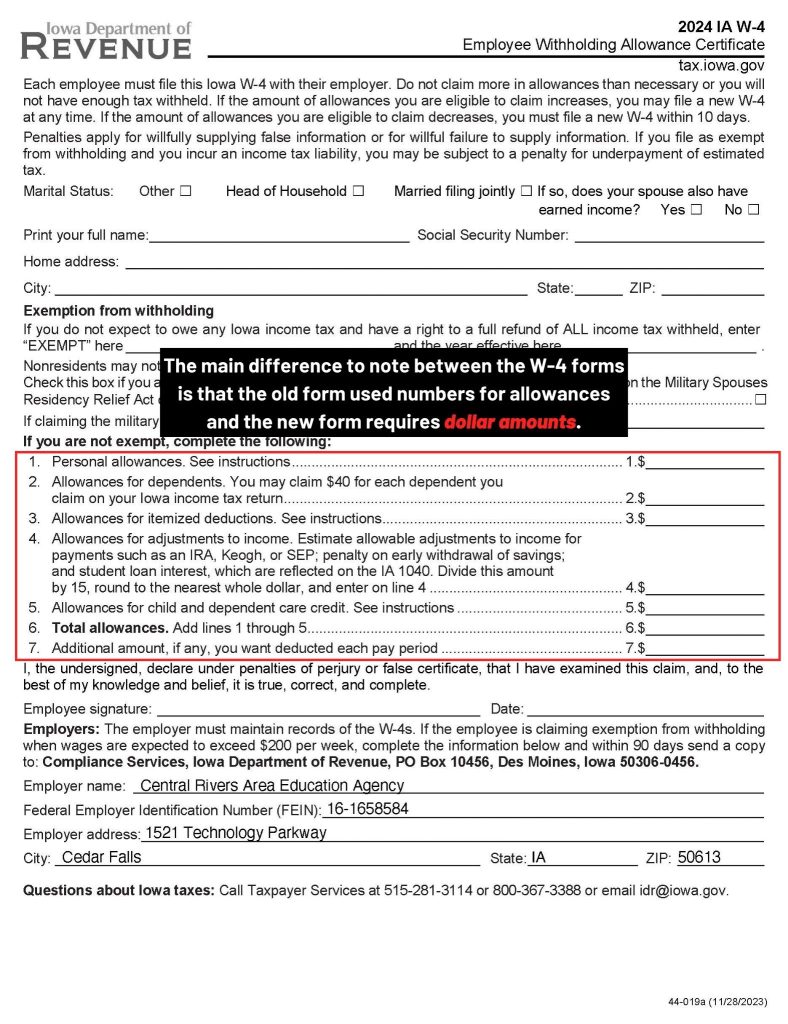

- The main difference to note between the new forms is that the old form was numbers and the new form requires dollar amounts.

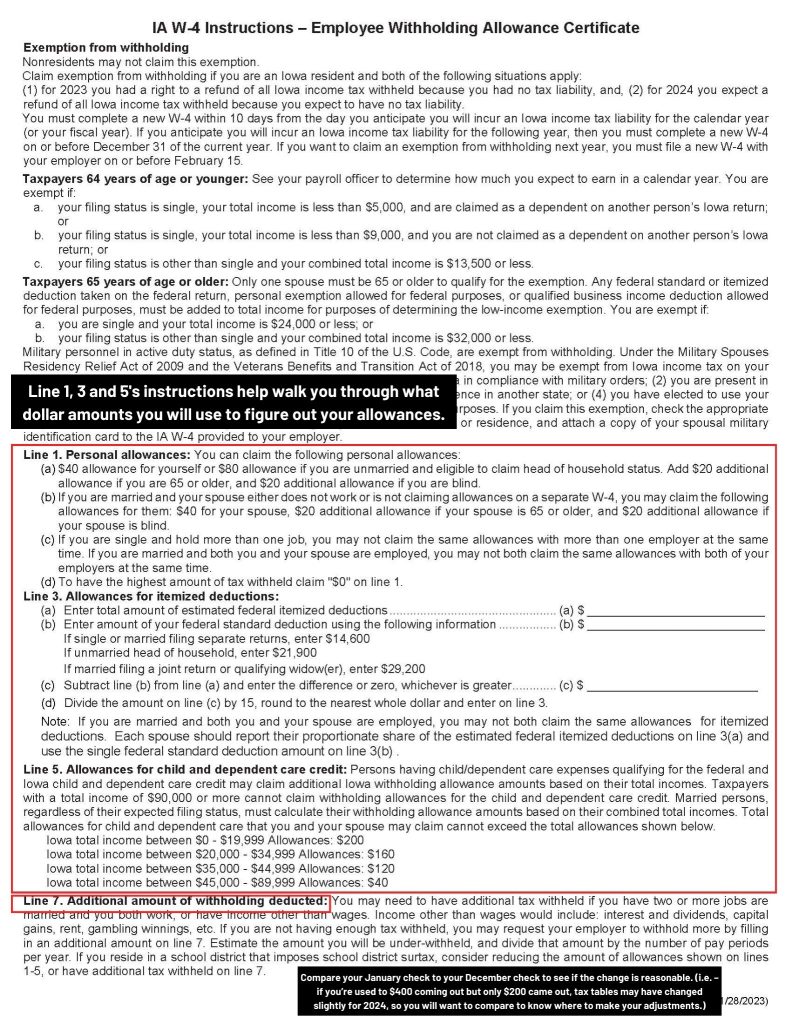

- If you had an additional dollar amount removed from your previous W-4 and you want that amount to carry over, you must fill out and submit a new W-4 to have that dollar amount removed from your pay stub. *This amount does not carry over from the old form. This is on “line 7” on the new W-4 form.

- Compare your January check to your December check to see if the change is reasonable. (i.e. – if you’re used to $400 coming out but only $200 came out, tax tables may have changed slightly for 2024, so you will want to compare to know where to make your adjustments.)

- You can change this form at any point during 2024.

- Line 1, 3, and 5’s instructions on the second page help walk you through what dollar amounts* you will use to figure out your allowances.

*A reminder that we cannot provide tax advice, so any questions should be directed to your tax preparer or an outside tax expert.

Who can I contact in the business office with questions?

While we begin our new partnership with Mississippi Bend AEA and their CFO, Jennifer Coombes, a reminder that our HR/Business office teams are here to help you! For generic business office inquiries, reach out to Pam Morrissey. If Pam is out of the office, then Jennifer can be contacted by email. Visit the Business Office/HR page on our staff website or check out the details below.

Business Office related questions should be directed to the following:

- Payroll – Shane Wolf

- A/P – Angie Sorenson

- Benefits – Kevin Klobassa

Robin Billerbeck – HR Specialist

- WebLink Resources

- Leaves (FMLA – Long term)

- Work Year Calendar

Kevin Klobassa – Benefits Specialist

- Insurance

- Health Savings Accounts

- Retirement (403b/IPERS)

- Work Injuries & Workers Compensation

Shirley Horak – HR Coordinator

- Human Resource Issues

- Board Policy

- School Messenger

Karl Kurt – Assistant Chief Administrator/ Director of HR

- Covid-19 Resources

- Emergency Procedures

- Employee Assistance Program (EAP)

- Employee Grievance

Pam Morrissey – Accounting Manager

- Grants and Budgets

- Agency Credit Cards

Angie Sorenson – Accounts Payable Specialist

- Expense Reimbursements

- Payment of Invoices

- Adding Vendors

Shane Wolf – Payroll Specialist

- Payroll

- Timeclock

- W-4 or Tax Withholding Changes

- Direct Deposit Changes